Currency Exchange on Your Trip to Japan

Japan is a cash-based society, making currency exchange a crucial part of the travel process. Here’s everything you need to know about currency exchange in Japan.

How to Get Cash in Japan – Withdrawing Money at ATM

Japan is a highly technological country, yet withdrawing cash from an ATM with a foreign card can be challenging. Most Japanese bank ATMs do not accept foreign-issued cards, with SMBC Bank being a notable exception. But there are some effective strategies that can help make the process of getting cash easier. Seven Bank ATMs (7-Eleven Stores) are the best for foreign cards.

Currency in Australia

A Travel Money Guide to Australia When visiting Australia, most tourists use a mixture of cash and cards. Although the use of cash is on the decline in Australia, the vast majority of shops and tourist attractions will accept hard currency as payment. This guide is a quick look at the currency used in Australia. What Currency is Used in Australia? The only currency used in Australia is the Australian dollar, which has been the official currency since 1966. Before 1966, Australians used British notes and coins. Outside of ‘mainland’ Australia, the Australian dollar or ‘Aussie Dollar’ is used […]

Do You Need Cash in Japan?

It is quite ironic that in a country usually associated with high technology, the culture of cash has not been completely eroded. Cash is still king in Japan, with 80% of consumer transactions made in cash. This is because people in Japan have embraced cash usage, and the country’s low crime rate makes it safe to carry cash.

Airalo eSim Review [2024]

Airalo eSim Review [2024] Our Take 4.5 S Money rating We don’t compare delivery or card fees because not all providers and banks offer these services. In a Nutshell Airalo provides some of the best international SIM cards for Australians. Access mobile plans for more than 200 countries and regions available directly from the Airalo app — staying connected has never been easier! Airalo eSim Airalo eSim Best – 200+ countries and regions covered worldwide Worst – Few plans include texting & calling Go to site Pros Access to eSIM plans in over 200 countries and regions Connects immediately to […]

2024 AUD EUR Forecasts

The Australian dollar is facing a mixed outlook against the Euro in 2024. The Australian dollar (AUD) has struggled against the Euro (EUR) in recent months. The EUR, which is the official currency of 19 of the 27 European Union (EU) member countries, peaked above €65.6¢ in January 2023. But it then saw a consistent decline, falling below the €60¢ barrier in the second half of the year. There are mixed forces at play which affect the value of the Euro, which covers a diverse area including the major economies of Germany, France and Italy

2024 AUD NZD Forecasts

The outlook for the Australian dollar (AUD) against the New Zealand Dollar (NZD) is relatively flat in 2024. New Zealand is a relatively small country but its currency punches above its weight. The New Zealand dollar (NZD) is traded on global exchange markets far more than the country’s relative share of global GDP. Its value is also of crucial interest to Australians, given New Zealand remains our most popular travel destination. In 2022-23, Australians made more than 1.19 million trips to the country, according to ABS data. While the two countries have close cultural and economic links, the exchange rate […]

2024 AUD GBP Forecasts

The Australian dollar (AUD) has been on a wild ride against the British Pound (GBP) in 2023 but 2024 may spell a different story. The Australian dollar (AUD) weakened considerably against the British Pound (GBP) in 2023 but it could strengthen slightly in 2024. The AUD peaked at almost 58p in February 2023, before sinking to almost 50p in August as multiple economic factors weighed down sentiment. The relative weakness in the Australian dollar has made the cost of travel more expensive for many Australians, with the United Kingdom our fourth most popular international destination, according to ABS data.

2024 AUD JPY Forecasts

The Australian dollar (AUD) could be set to weaken against Japan’s Yen (JP¥) in 2024 if its central bank starts to unwind the country’s ultra-loose monetary policy settings. The Australian dollar (AUD) has traded around decade highs against Japan’s Yen (JP¥) in 2023 although the situation may be set to change as its economy begins to stir, according to analysts. The potential turnaround follows a strong year for the AUD against the JP¥, peaking at almost JP¥97.5 in June 2023 before falling to JP¥92.76 in August. Japan’s strong currency also helped underpin surging inbound tourism after it re-opened in October […]

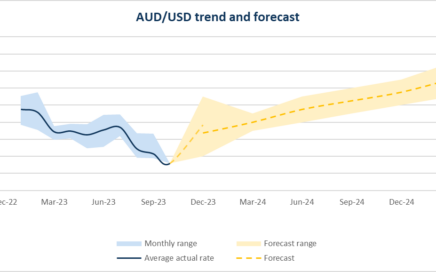

2024 AUD USD Forecasts

The value of the Australian dollar (AUD) against the US Dollar (USD) could be about to lift in 2024 after a prolonged bout of weakness. The Australian dollar (AUD) lost almost 6 per cent against the US dollar (USD) over the first nine months of 2023 thanks to rising US interest rates and China’s economic slowdown. But analysts are predicting a slow rebound in 2024, albeit with some short-term weakness along the way. It has been a difficult period for the AUD, which momentarily peaked above US71¢ in early-February 2023 before falling to around US62¢ in October – its lowest […]

2024 Australian Dollar Forecasts

Australian Dollar Forecasts for 2024 Track the Australian dollar The Australian dollar’s (AUD) performance will be driven by a diverse range of factors in 2024. The Australian dollar (AUD) is one of the most heavily traded currencies in the world, with its value influencing the decisions of individuals, businesses and government. Exchange rates are notoriously volatile with the AUD’s performance driven by factors including Australia’s interest rates, inflation, terms of trade, and risk sentiment. While the value of the AUD is typically measured against the US dollar (USD) – which is the world’s principal reserve currency – the AUD’s value […]

How to Avoid International Transaction Fees

Are you planning a much-deserved trip abroad? Or have you just returned from a lovely relaxing holiday, only to be shocked when opening your card statement? What in the world are all these extra fees?!! I’ve been there myself. I had no idea an innocent online shopping spree or overseas trip could come with so many “uninvited guests”.

NAB International Transaction Fee

So, you’ve come across this guide, likely because you’ve had that all-too-familiar sinking feeling after seeing those unexpected charges on your card statement. Whether those fees appeared after an overseas trip or a virtual shopping spree, they have a knack for taking you by surprise. Or you’re gearing up for an upcoming holiday and want to make sure your hard-earned money stays in your pocket, where it belongs.

CommBank International Transaction Fee

I’m going to assume that you’ve made your way to this page because you’ve found some unexpected charges on your card statement, either on return from your trip overseas or after spending too much online. Or maybe you’re planning a trip and want to ensure you don’t waste your hard-earned money.

Credit Cards With No International Fees

Tired of those hidden fees that pop up whenever you’re making purchases abroad or even just shopping online? We get it – those charges can quickly add up and become a real headache. Imagine being hit with a 3% foreign transaction fee every single time you make a purchase. It’s a frustration many travellers and online shoppers are all too familiar with and fed up with.

Debit Card With No International Fees

Editorial note: We may not cover every product in this category. For more information, see our Editorial guidelines.

The Price of Happiness in Every Country

It’s not what you earn; it’s the way that you spend it — that’s what leads to happiness. So claim the authors of a Harvard-affiliated study that proposed eight principles to “help consumers get more happiness for their money.” Eight principles that begin with “(1) buy more experiences and fewer material goods” and end with “(8) pay close attention to the happiness of others.” Whether these techniques work or not, they add an important sense of quotidian nuance to what has become a rather academic debate about how much money you need to be happy. Notice that this ancient question […]

Citibank International Transaction Fees

Important information: Citi Australia has been acquired by NAB, so Citibank accounts are no longer available to open for new customers. This information applies to and is still valid for existing Citi customers. However, we have some tips for those of you still looking to save on overseas fees.