Travelex Money Card Review [2024]

Our Take

3.8

In a Nutshell

The Travelex Money Card allows you to spend like a local abroad, with no transaction or ATM withdrawal fees and generous withdrawal limits.

Travelex Travel Card

Travelex Travel Money Card

- Best No ATM withdrawal fees

- Worst Exchange rates

Pros

- Unlimited free ATM withdrawals overseas and generous withdrawal limits

- No conversion fees with online top-ups

- Lock in exchange rates

- Convenient app to manage card

- Free home delivery or collection in-store

- Free WiFi access at millions of locations worldwide

- MOZO Travel Card Winner 2022 and 5-star Canstar rating (2016–2020)

Cons

- Only 10 currencies supported

- A$10 card closing fee

- Exchange rates are worse than the mid-market rate

- Poor customer service reviews

- No interest on your balance

- $4 monthly inactivity fees apply if you don't use your card within 12 months

Avoid Nasty ATM Fees

Avoid Nasty ATM Fees

Get some cash in a flash.

With S Money, you know you'll always get the best rate.

The Travelex Money Card (formerly the Travelex Cash Passport) provides a safe way to access and spend multiple currencies at millions of outlets worldwide.

Few travel cash cards are as liberal with international ATM use as Travelex, which has no ATM withdrawal fees and a generous A$3,000 withdrawal limit within 24 hours. It also imposes no limit to the number of times you can visit an ATM in any given month — something almost unseen in other travel cards.

However, it’s not without limitations. With access to just 10 major currencies, travellers covering an extensive area may not be able to load all the currencies they need onto the card. This is where a Wise Multi Currency Card or Revolut travel card may be better.

The average Travelex review on Trustpilot is 4.4 stars, with 74% of reviewers rating it 5 stars (from 13,813 users on 27 January 2023). The most common complaints were about the poor exchange rates and issues with unhelpful customer service.

What is the Travelex Money Card?

The Travelex Money Card is a prepaid travel card that can be used abroad wherever Mastercard is accepted and allows you to:

- Load up to 10 major currencies

- Lock in exchange rates before you travel

- Make purchases overseas both online and in-store

- Access your money safely and quickly from millions of ATMs worldwide

Note: The Travelex Money Card replaces the Cash Passport. Travelex no longer sells Cash Passports, but if you already have one of these cards, you can continue reloading it or managing your account until it expires.

How it works

You can use your Travelex Money Card just like a regular Mastercard debit card but with one key difference.

The card can hold up to 10 currencies and you can transfer between currencies at any time either online or using the Travelex app.

With money loaded onto the card, you can use it almost anywhere Mastercard is accepted to withdraw cash, make purchases in-store, and shop online in a supported foreign currency.

Travelex will automatically debit your card in the local currency if there’s an available balance. If you don’t have the right currency, it will deduct the payment from one of the other currencies you hold in this order:

- Australian dollars

- US dollars

- Euros

- Great Britain pounds

- New Zealand dollars

- Thai baht

- Canadian dollars

- Hong Kong dollars

- Japanese yen

- Singapore dollars

Example

Peter travels from Australia to the UK and France with a stopover in Singapore. Before he leaves, he loads British pounds, euros, and Singapore dollars onto his Travelex Money Card.

As he travels, purchases made in Singapore dollars are automatically deducted from his Singapore dollars fund. In the UK, purchases are deducted from his British pounds balance. When he heads to France, he has S$80 and £5 remaining, along with an untouched euros balance.

On his last day in France, he buys a meal at the airport but doesn’t have any euros left on his card. Travelex uses up the last few pounds first, then deducts Singapore dollars to pay off the remainder.

Top up your Travelex Money Card

The best way to reload your Travelex card is online via the Travelex website or Money App.

You can also top up at a Travelex store or directly via BPAY but reloads not made through travelex.com.au or the Travelex Money App incur a fee of 1% of the amount.

You can hold up to 10 currencies and move money between each currency as required.

Australian dollars (AUD), US dollars (USD), euros (EUR), British pounds (GBP), New Zealand dollars (NZD), Thai baht (THB), Canadian dollars (CAD), Hong Kong dollars (HKD), Japanese yen (JPY), and Singapore dollars (SGD)

Travelex spending limits

Spending limits apply to most travel cards as a way to prevent fraud and add security to your card. The table below lists the spending limits in Australian dollars or the currency equivalent.

| Transaction Type | Limit |

| Minimum load | $100 |

| Maximum load | $100,000 |

| Maximum total balance | $100,000 |

| EFTPOS transactions within 24 hours | $15,000 |

| ATM withdrawals within 24 hours | $3,000 |

| Cash over the counter within 24 hours | $350 |

Travelex card fees

The Travelex Money Card comes into its own with its fee structure. With no currency conversion fees or ATM fees, the Travelex card eliminates a lot of the hidden costs associated with spending money overseas.

Fees associated with inactivity can start to add up and closing the account incurs a A$10 fee so this card is best recommended for frequent travellers who will use the card at least once a year until its expiry.

| Getting your Travelex card | FREE via the Travelex website or app*

*Fee set by the agent you purchase the card from. |

| Adding money | Via the Travelex website or app: FREE

In-store (into AUD): 1.1% of the amount or A$15, whichever is greater In-store (into foreign currency): FREE Via BPAY (not through Travelex website): 1% of top-up amount |

| Spending money | Free if you hold the currency in your account.

If you don’t hold the currency in your account, you’ll pay the ‘spend rate’, an exchange rate determined by Mastercard Prepaid. |

| Currency conversion | FREE |

| Withdrawing from an ATM*

*Some ATM operators may charge their own fees |

FREE |

| Replacing a lost or stolen card | FREE |

| Getting an additional card | A$5 |

| Monthly inactivity fee*

*Charged when no transactions are made on the card in the previous 12 months |

A$4 per month |

| Closing your card or withdrawing your funds*

*Set and charged by Mastercard Prepaid |

A$10 |

Travelex card exchange rates

The ability to load your card with up to 10 currencies means you avoid excessive conversion fees every time you make a purchase.

You can also lock in a favourable exchange rate each time you load the card (although the opposite is also true — you might miss out on a better deal).

If you don’t hold the local currency for a particular purchase, Travelex will convert money from another currency you hold using what they call a ‘spend rate’. This rate is the individual foreign exchange rate set by Mastercard Prepaid, which you can calculate here.

In this respect, Travelex is not as good as Revolut or Wise travel cards, both of which use the mid-market exchange rate (the rate you see on Google or XE, which are typically better than the rates provided by Travelex).

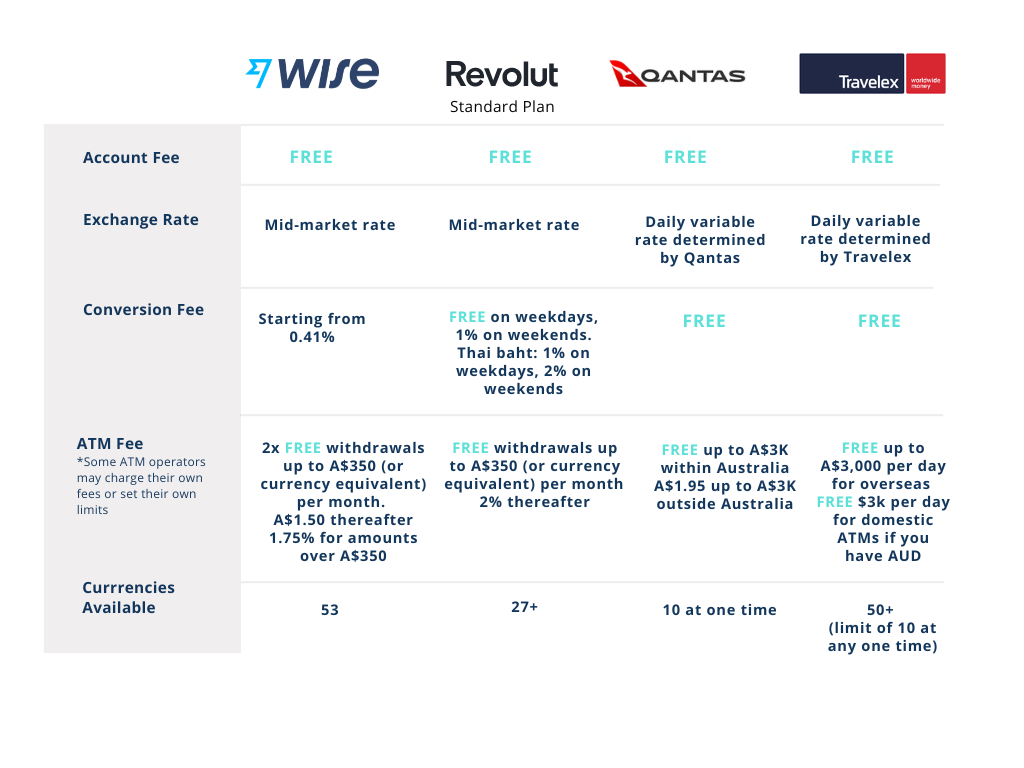

How it compares

| Revolut (Standard plan) | Wise | Qantas Travel Money | Travelex Money Card | |

|---|---|---|---|---|

| Account Fee | Free | Free | Free | Free |

| Exchange rate | Mid-market rates | Mid-market rates | Set by Qantas | Set by Travelex |

| Conversion Fee | Free on weekdays, 1% on weekends | Starting from 0.41% | Free | Free |

| ATM Fee | Free ATM withdrawals up to $350. 2% thereafter | 2 free withdrawals. $1.50 + 1.75% thereafter | $1.95 up to $3000 | Free up to A$3,000 per day |

| Currencies available | 25+ | 53 | 10 at any one time | 10 at any one time |

Get your Travelex card

As one of the largest currency exchange brands in Australia, it’s easy to get your hands on the Travelex Money Card. You will need a photo ID to order your card.

1. Order your card

Order your Travelex Money Card online and receive free delivery to your home. Alternatively, visit your local Travelex store to buy or collect the card. In-store rates vary from online rates.

2. Activate your card

Register your account online to activate your card. If you purchase or collect your card in-store, they will activate it for you.

3. Top up

You can top up your Travelex card online, at a participating Travelex outlet in Australia, over the phone, or using the Travelex Money app.

The Travelex Money app

Managing your travel card has never been easier with the Travelex Money app, available on Apple and Android phones.

Through the app, you can:

- View your account balance

- Top up your card

- Check past transactions

- Transfer funds across currencies

- Freeze and unfreeze your card

- Locate the nearest Mastercard ATMs

Mixed reviews on the Apple App and Google Play stores suggest the app is a work in progress and may need to improve its functionality.

FAQs

It’s true, your Travelex Money Card gives you 3 months of access to free WiFi at millions of locations worldwide.

All you need to do is head to the Boingo website, verify your card number, and register an account. Once you’ve done that, you’ll have free WiFi access from Boingo hotspots for 3 months on up to 4 devices at a time.

If you’ve ordered your Travelex card online and selected home delivery as your collection method, your card should arrive within 5-7 business days. If you need your card sooner, you can collect your card from your nearest Travelex store.

Travel cards like Travelex allow you to travel safely with a large sum of money without carrying wads of cash. Travelex has checks and balances in place to ensure your hard-earned savings are protected.

Your Travelex Money Card comes secure with a chip and PIN, as well as a signature panel on the back. You can also freeze and unfreeze your card at any time if you misplace it or detect unusual activity on it.

Travelex also monitors activity on your card daily and will contact you if suspicious behaviour is detected.

If you think your card has been stolen, skimmed, or otherwise breached, a Global Emergency Assistance helpline is available 24/7. A full list of international phone numbers for this helpline is available here.

You can use Travelex at any ATM where the Mastercard logo is displayed. ATM withdrawals are free, with a withdrawal limit of A$3,000 within a 24-hour period.

It’s worth remembering that some ATM operators apply their own fees and limits to their ATMs but you will usually be notified of these costs before completing the transaction.

If your card is lost, stolen or damaged, you should contact Travelex Card Services immediately. A full list of international phone numbers for this helpline can be found here.

Travelex can send you a replacement card or arrange for emergency funds in the local currency to be sent to you — normally available within 20 minutes.

For security, the Travelex Money App also allows you to freeze your card to protect your balance and ensure no unauthorised payments are made. If you find your card, you can unfreeze it using the app.

To avoid being left cashless, you can buy a backup card for A$5 when you buy your main Travelex Money Card. You can continue using this card even if you lose the main card.