AUD USD Forecasts for 2023

This article focuses on what banks predict for the AUD to USD exchange rate long term in 2023.

The 2024 AUD USD Forecasts are out now

With most of 2023 out of the way, attention turns to 2024.

Now that most economists have released their predictions for the AUD USD exchange rate, head here to find out the most up to date forecasts:

AUD to USD: Slow growth to impact currencies

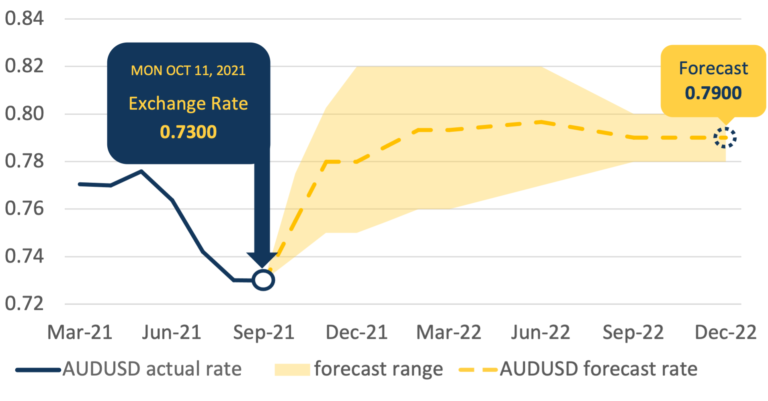

In 2022, the AUD to USD exchange rate continued its' downward trajectory, hitting 2-year lows around 65 cents in September. Major Australian banks maintained their lowered AUD forecasts in 2023, with an expected range between 65 and 70 US cents compared with 0.651 today.

Source: Australian Big 4 banks aggregate data

AUD to USD

AUD to USD

AUD to USD Predictions in 2023

In the short term

While the banks have predicted for the AUD to USD to remain low over the long term, there are plenty of influences on the Australian dollar that can improve exchange rates in the short term. These include:

- Australian economic growth slows, but less than expected

- A weaker US dollar as the US economy struggles

- China’s demand for Australian commodities grow, despite weaker growth

- Economic growth on a global scale recovers

What do bank analysts think about the AUDUSD in the long term?

- ANZ – Expect the AUDUSD exchange rate to be 73 cents by June 2023

- Westpac – Predict the AUDUSD rate to be 67 cents by June 2023

- CBA – CBA forecast the AUDUSD rate to be 62 cents by June 2023

- NAB – NAB’s forecast shows the AUDUSD rate around 70 cents by the mid-year of 2023

The best time to exchange AUD to USD

If you are travelling overseas and need to buy US dollars, the best AUD to USD exchange rate is when it is high. Alternatively, if you are selling US currency either in cash or through a transfer, you want the rate to be as low as possible.

Whether you are buying or selling US dollars, no one can tell you when this "perfect" time is, but you can track the rate for free.

You set the rate you would like and let us to the work. We will email you when the AUD gets within the range you would like to buy US dollars.

Latest Australian Dollar to US Dollar news

2024 AUD USD Forecasts

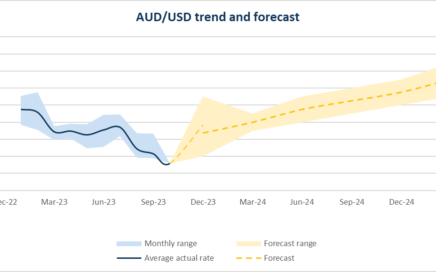

The value of the Australian dollar (AUD) against the US Dollar (USD) could be about to lift in 2024 after a prolonged bout of weakness. The Australian dollar (AUD) lost almost 6 per cent against the US dollar (USD) over the first nine months of 2023 thanks to rising US interest rates and China’s economic slowdown. But analysts are predicting a slow rebound in 2024, albeit with some short-term weakness along the way. It has been a difficult period for the AUD, which momentarily peaked above US71¢ in early-February 2023 before falling to around US62¢ in October – its lowest […]

2024 Australian Dollar Forecasts

Australian Dollar Forecasts for 2024 Track the Australian dollar The Australian dollar’s (AUD) performance will be driven by a diverse range of factors in 2024. The Australian dollar (AUD) is one of the most heavily traded currencies in the world, with its value influencing the decisions of individuals, businesses and government. Exchange rates are notoriously volatile with the AUD’s performance driven by factors including Australia’s interest rates, inflation, terms of trade, and risk sentiment. While the value of the AUD is typically measured against the US dollar (USD) – which is the world’s principal reserve currency – the AUD’s value […]

2023 Australian Dollar (AUD) Forecasts

This article looks at what the banks are anticipating for the Australian dollar (AUD) over the long term in 2023. The 2024 Forecasts for the Australian Dollar are out now With most of 2023 out of the way, attention turns to 2024. Now that most economists have released their predictions for the Australian dollar, head here to find out the most up to date forecasts: