AUD to EUR Exchange Rate Forecasts for 2023

This article looks at what the banks are predicting for the AUD to EUR exchange rate over the long term in 2023.

The 2024 AUD EUR Forecasts are out now

With most of 2023 out of the way, attention turns to 2024.

Now that most economists have released their predictions for the AUD EUR exchange rate, head here to find out the most up to date forecasts:

AUD to EUR

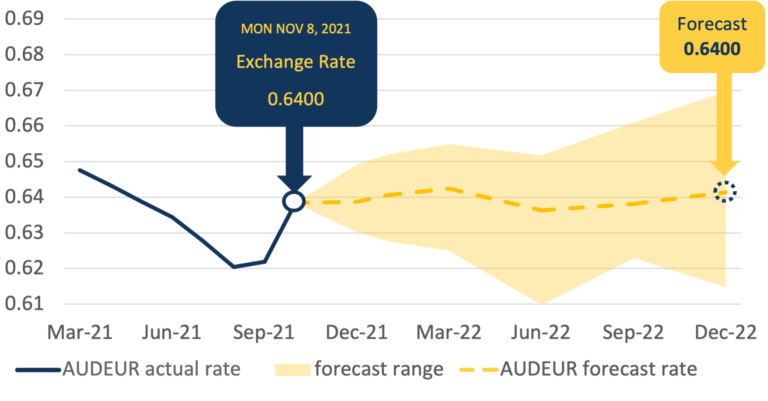

Major Australian banks have a similar predictions for the Australia dollar to the Euro - reflected in their AUD to EUR forecasts in 2023. Generally, their outlook for the Australian dollar is slightly more optimistic compared to the EUR.

AUDEUR forecasts from bank majors 2023

Source: Multinational bank aggregate data

AUD to EUR Predictions in 2023

In the short term

While major banks predicted the AUD to EUR to rise ever so slightly in the long term, there are plenty of influences on both the Australian dollar and the Euro that have an impact in the short term. These include:

- Tourism commenced earlier in Europe than in Australia, but Australia's smaller economy bounces faster and greater than in Europe

- Central bank policies to stimulate the economy is more effective in Australia than in Europe

- Australia and Europe are at greater risk of inflationary pressures, there’s only so much the government can do to help

- China’s demand for Australian commodities grows relatively more than European commodities

What do bank analysts think about the AUD EUR in the long term?

- ANZ says there’s too much uncertainty and expects the AUD to EUR exchange rate to end 2023 at 0.6100

- Westpac anticipates continued focus on Central Bank policy, predicting the AUD to EUR rise to around 0.6700 by the end of 2023

- NAB predicts the AUD to EUR forecast exchange rates for the end of next year to decline towards 0.6200

The best time to exchange AUD to EUR

If you are travelling to Europe and need to buy Euros, the best AUD to EUR exchange rate is when it is high. Alternatively, if you are selling Euro's currency either in cash or through a transfer, you want the rate to be as low as possible.

Whether you are buying or selling Euros, no one can tell you when this "right" time is, but you can track the rate for free.

You set the rate you would like and let us to the work. We will email you when the AUD gets within the range you would like to buy Euro dollars.

Latest AUD EUR news

2024 AUD EUR Forecasts

The Australian dollar is facing a mixed outlook against the Euro in 2024. The Australian dollar (AUD) has struggled against the Euro (EUR) in recent months. The EUR, which is the official currency of 19 of the 27 European Union (EU) member countries, peaked above €65.6¢ in January 2023. But it then saw a consistent decline, falling below the €60¢ barrier in the second half of the year. There are mixed forces at play which affect the value of the Euro, which covers a diverse area including the major economies of Germany, France and Italy

The Best European Travel Insurance for Australians

An adventure around Europe is a rite of passage among Australians. While there’s plenty to look forward to, it’s also important to prepare for unplanned events. That’s where getting travel insurance for Europe can help. A comprehensive policy makes sure you receive the medical treatment you need in an emergency and reimburses you for lost, stolen, or damaged personal belongings. These days, comparing international travel insurance policies can also protect you from unexpected costs or emergencies arising from COVID-19.

Best Travel Money Cards for Europe

Planning a European adventure from Australia? Whether you’re exploring the romantic streets of Paris, the historic landmarks of Rome, or the cultural hubs of Barcelona, having the right travel money card can come in handy when overseas. All across Europe, Australian debit cards are accepted at ATM’s as well as payment terminals in supermarkets, restaurants and in taxis. An everyday bank card in Australia can come with unwelcome fees that are that easy to spot. Debit and prepaid cards that are specifically used for travel to Europe can have better exchange rates, lower fees and even allow you to preload […]