Travel Money Oz: Everything You Need to Know

Travel Money Oz is one of Australia’s biggest foreign exchange companies. It has more than 60 stores across the country and 60+ currencies available to buy. Its commercial services include:

Travel Money Oz Currency Exchange

Travel Money Oz sells more than 60 foreign currencies at stores across Australia. They also buy back any leftover foreign currency. Foreign currency exchange is only available in-store, not online.

Travel Money Oz exchange rates

As with Travelex and Crown Currency, Travel Money Oz uses a retail exchange rate rather than the mid-market rate (which is the rate shown on Google and is the most accurate meeting point between the buy and sell prices of two currencies).

Since Travel Money Oz does not add commissions or fees to each foreign currency transaction, it makes its profit by marking up the exchange rate.

Travel Money Oz exchange rates work a little differently from most other exchange companies. Instead of providing real-time rates, they lock in their rates every morning.

This means Travel Money Oz exchange rates don’t fluctuate throughout the day. For example, the AUD to USD rate you see in the morning will be the same in the afternoon.

The exchange rates described on the Travel Money Oz website are not indicative of the rate you may be given in-store. This is because online rates are only for the Currency Pass travel card. However, stores may be willing to match the website rate.

Travel Money Oz also has a few offers to ensure you get a good deal on your currency exchange.

Best Price Guarantee

This is a promise to provide the best exchange rate in Australia. If you find a better same-day deal from another foreign exchange company, Travel Money Oz guarantees to beat it in-store.

They promise to beat the transaction price by A$1 or else give you A$100, which will be given as a currency travel card or loaded onto your existing Currency Pass card.

You must provide proof of the better exchange rate from an Australian competitor either as an official, written quote or a published rate.

Cash Commitment

The Cash Commitment is a guarantee that Travel Money Oz will have certain currencies in stock when you visit them in-store.

If the currency you need is unavailable, you can choose to either place a deposit and receive a bonus when the cash is available for pickup, or walk away with a $20 Travel Money Oz voucher (with 6 months’ validity).

The bonus depends on how much you spend:

- $20 if you spend $200-$999

- $50 if you spend $1000-$2,999

- $100 if you spent $3,000 or more

Only 7 currencies are covered under the Cash Commitment. These are:

- Great British Pound (GBP)

- Euro (EUR)

- United States Dollar (USD)

- New Zealand Dollar (NZD)

- Japanese Yen (JPY)

- Singapore Dollar (SGD)

- Thai Baht (THB)

Rate Move Guarantee

Worried that you may miss out if the exchange rate improves after you’ve bought your currency? Travel Money Oz protects you against this with the Rate Move Guarantee.

If the retail exchange rate on certain currencies improves in the next 14 days after you’ve purchased your foreign currency in-store, you’ll receive the difference (kind of like a refund).

Only 11 currencies are covered by the Rate Move Guarantee:

- Great British Pound (GBP)

- Euro (EUR)

- United States Dollar (USD)

- New Zealand Dollar (NZD)

- Singapore Dollar (SGD)

- Indonesian Rupiah (IDR)

- Fijian Dollars (FJD)

- Thai Baht (THB)

- Japanese Yen (JPY)

- Canadian Dollar (CAD)

- Chinese Yuan (CNY)

When you buy your foreign currency, ask the staff member to add the Rate Move Guarantee to your transaction at no extra cost. They will need a few personal details.

If, in the next 14 days, the Travel Money Oz exchange rate improves, you can return to the same store to submit a Rate Move Guarantee claim. Travel Money Oz will pay the difference (in Australian dollars) into your chosen bank account within 7 days.

At a Glance: Travel Money Oz Fees and Charges

Travel Money Oz does not charge a commission or fee to convert your AUD into a foreign currency (or vice versa). The way they make their profit is to add a markup onto the exchange rate itself.

While the markup isn’t explicitly stated, there’s an easy way to determine what it is. Simply compare the Travel Money Oz quote you are given with the mid-market exchange rate, which you can find on Google or XE.com.

Travel Money Oz Currency Pass

The Currency Pass (formerly the Key to the World Currency Card) is a travel money card issued by Travel Money Oz.

With it, you can load up to 10 currencies, lock in the exchange rate, and use it like you would a debit card overseas. You can order the card online, through the app, or in-store.

How it works

Treat your Currency Pass as a regular Mastercard debit card; you can use it almost anywhere Mastercard is accepted.

Simply load currency to the value of between A$20 and A$50,000 (in-store; if you pay online or via the app, the maximum is A$10,000).

Then you can make purchases in-store, shop online in a supported currency, and withdraw cash from ATMs.

The advantage of the Currency Pass is that it can hold multiple currencies (up to 10) at the same time. You can transfer money between currencies whenever you need to, using the Travel Money Oz app or website.

Supported currencies include:

- Australian Dollar (AUD)

- United States Dollar (USD)

- Euro (EUR)

- Great British Pound (GBP)

- New Zealand Dollar (NZD)

- Canadian Dollar (CAD)

- Hong Kong Dollar (HKD)

- Japanese Yen (JPY)

- Singapore Dollar (SGD)

- Thai Baht (THB)

Hot tip: Plan your reloads in advance! Bank transfer will take at least one business day and BPAY takes 3 business days on average to load onto your card.

Travel Money Oz card fees

The Currency Pass has no currency conversion or inactivity fees but it still incurs the same Travel Money Oz markup on exchange rates, not to mention the ATM fees will start to add up.

| Currency Pass card fees

|

Amount (in Australian dollars)

|

| Getting your Currency Pass online or in store

|

FREE

|

| Adding money

|

Via bank transfer: FREE

In-store: FREE Online via the portal or app using a debit/credit card: 1.1% of the total amount Via BPAY: 1% of the total amount

|

| Spending money in the same currency*

*Some merchants may charge a fee

|

Free if you hold the currency in your account.

If you don’t hold the currency in your account, you’ll pay the ‘spend rate’, an exchange rate determined by Mastercard Prepaid.

|

| Currency conversion

|

FREE

|

| Withdrawing from an ATM*

*Some ATM operators may charge their own fees.

|

International withdrawals: USD 2.50 EUR 2.50 GBP 2.00 NZD 3.50 THB 80.00 CAD 3.50 HKD 18.00 JPY 260.00 SGD 3.50 AUD 3.50 (for international ATM withdrawals in countries not mentioned above or if you have insufficient funds in the relevant currency to cover the whole transaction)Domestic withdrawals (in AUD currency): 2.95% of the amount withdrawn |

| Replacing a lost or stolen card

|

$10

|

| Monthly inactivity fee

|

FREE

|

| Closing your card or withdrawing your funds*

*Set and charged by Mastercard Prepaid

|

A$10

|

Where to buy a Travel Money Oz Currency Pass

You can buy your Currency Pass travel card from any Travel Money Oz, Flight Centre, Universal Traveller, or Travel Associates store. You can also buy it online at travelmoneyoz.com and receive it in the mail (allow up to 14 days for delivery).

The Travel Money Oz App

The Travel Money Oz App (previously called The Key to the World) is where you can manage your travel money card. Using the app, you should be able to:

- Add money

- Block and unblock your card

- Track your spending

- View your balance

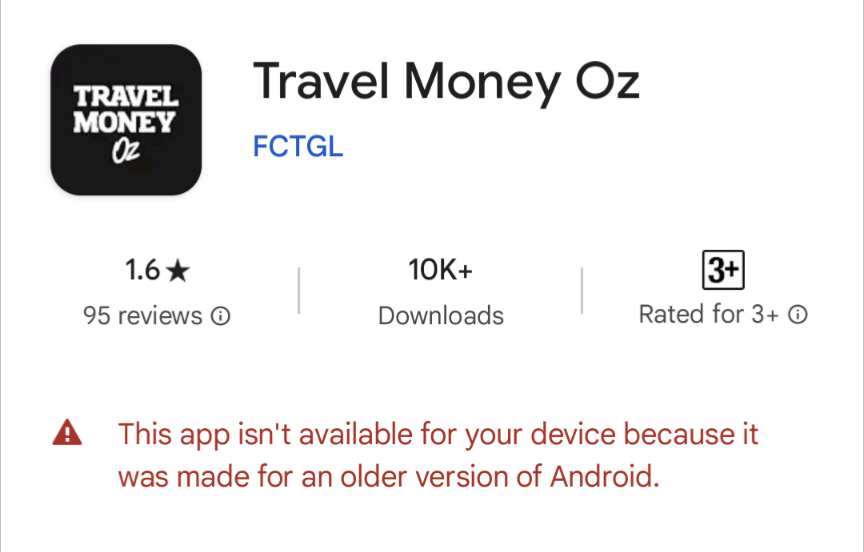

According to their website, you can download the Travel Money Oz app from both Google Play and the Apple App Store. However, the Android version of the app is currently unavailable on the most recent version of Android. Poor reviews (1.5 stars on the App Store and 1.6 stars on Google Play) report that the app is buggy and unreliable.

Travel Money Transfers

On the Travel Money Oz website, you can send money internationally across more than 30 currencies, starting at a minimum of A$200.

To use the service, you will need to sign up to the Travel Money Transfers online portal. Funds usually take between 24 and 48 hours to arrive in the intended account, although it can often happen on the same day.

According to Travel Money Oz, their exchange rates often beat major bank exchange rates by up to 3%. However, they also offer a Rate Beat Guarantee, under which they promise to beat any better rate that you find elsewhere. There are no transfer fees.

Travel Money Oz uses the Australian-based money transfer company Send for this service.

FAQs

Travel Money Oz has decent reviews on Trustpilot, with an average rating of 4.4 out of 5 stars. Reviewers consistently praise the in-store customer service and the good deals on exchange rates.

The most common complaints are about the lack of assistance, particularly when dealing with issues related to the Currency Pass travel card.

Travel Money Oz has more than 60 stores across Australia, mostly in the major capital cities, including Brisbane, Sydney, Melbourne, Adelaide, and Perth.

There are also stores on the Gold Coast and the Sunshine Coast, as well as in Newcastle, Maitland, Shellharbour, Geelong, Bendigo, and Ballarat. You can find your nearest Travel Money Oz store here.

Once upon a time, you could order your currency online on the Travel Money Oz website and pick it up in-store. However, this service is currently unavailable.

If you want to buy foreign currency with Travel Money Oz, you must do it in-store.

Returned from overseas with a load of extra cash? Travel Money Oz is happy to buy more than 55 foreign currencies in exchange for Australian dollars — as long as the banknotes are in reasonable condition.

Currencies they’re willing to buy include:

Barbados Dollar (BBD), Bahamas Dollar (BSD), Bahraini Dinar (BHD), Brazil Real (BRL), Bruneian Dollar (BND), Canadian Dollar (CAD), CFP Franc (XPF), Chilean Peso (CLP), Chinese Yuan (CNY), Czech Republic Koruna (CZE), Danish Krone (DKK), Euro (EUR), Fijian Dollars (FJD), Great British Pound (GBP), Hong Kong Dollar (HKD), Hungarian Forint (HUF), Indian Rupee (INR), Indonesian Rupiah (IDR), Israeli Shekel (ILS), Japanese Yen (JPY), Jordanian Dinar (JOD), Kuwaiti Dinar (KWD), Malaysian Ringgit (MYR), Mauritian Rupee (MUR), Mexican Peso (MXN), Macau Pataca (MOP), Moroccan Dirham (MAD), New Zealand Dollar (NZD), Norwegian Krone (NOK), Omani Rial (OMR), Pakistani Rupee (PKR), Papua New Guinea Kina (PGK), Philippine Peso (PHP), Polish Zloty (PLN), Samoan Tala (WST), Saudi Arabian Riyal (SAU), Singapore Dollar (SGD), Solomon Islander Dollar (SLB), South African Rand (ZAR), South Korean Won (KRW), Sri Lankan Rupee (LKA), Swedish Krona (SEK), Swiss Franc (CHF), Thai Baht (THB), Tongan Pa'anga (TOP), Turkish Lira (TUR), United Arab Emirates Dirham (AED), United States Dollar (USD), Vanuatu Vatu (VUV), Vietnamese Dong (VNM)

Few currency exchange stores buy back foreign coins and Travel Money Oz is no exception.

However, you can drop them off at any Travel Money Oz store as a donation to UNICEF’s Small Change, Big Difference program, which helps protect children around the world.

With 5 years’ validity, your Currency Pass travel card is likely to last well beyond your travels. Fortunately, the card can be used just like a regular debit card within Australia.

You can use it to make purchases both in-store and online in Australia, as well as to withdraw money from ATMs. Just be aware that withdrawing Australian dollars from a domestic ATM will incur a 2.95% withdrawal fee.

You can make general enquiries about Travel Money Oz through the contact form on their website. Responses are generally provided within 2 business days.

If you’re looking for a more immediate response, you can call 1300 426 997. You will encounter an automated phone service with options to discuss the travel card, money transfers, and currency exchange.

For Travel Money Oz currency exchanges, your call will be forwarded to an expert at a store in your state or territory.

Travel Money Oz started as seven separate businesses operated by Nationwide Currency Services (NCS). In 2006, Flight Centre bought NCS. In 2011, NCS became the company we know today — Travel Money Oz.

In 2015, Travel Money Oz merged with Travel Money NZ to form the Travel Money Group. The business still operates as Travel Money Oz in Australia.

Between 2011 and 2019, Travel Money Oz doubled in size, opening more than 130 stores in Australia, New Zealand, and America and becoming one of Australia’s largest currency exchange services.

*Source: ACCC