This week, the Australian dollar moved higher after recently released figures showed that inflation was on the rise. In fact, across the globe, exchange rates have been adjusting recently to higher than expected surges in inflation.

But why does inflation change the value of the Australia dollar?

Well, it's because inflation and expectations of inflation have a direct influence on interest rates. Interest rates in turn, have a big impact on the value of a currency. This makes inflation, interest rates and the Australian dollar all connected.

Inflation and Interest rates

According to the Reserve Bank of Australia (RBA), inflation is:

An increase in the level of prices of the goods and services that households buy. It is measured as the rate of change of those prices

The RBA's definition of inflation is really important because as a central bank, they set interest rates (also known as monetary policy). Monetary policy is largely guided by inflation.

For decades now, the RBA has targeted an inflation rate of 2-3%. This means that when inflation is below 2%, they are much more likely to cut interest rates and when inflation is above 3% they are more likely to increase interest rates. Let's look at an example of each situation.

In early 2020 when national lockdowns came in and the economy nosedived, the RBA knew that inflation would fall well below 2%. They cut interest rates to 0.1% to help cushion the fall, support the economy and hopefully, eventually move inflation back up when the economy recovered.

In contrast, the RBA increased interest rates during 2010 when the economy was picking up after the GFC. Inflation had moved above the 2-3% range and the central bank took action.

Not all inflation is the same

So recently when the Australian Bureau of Statistics (ABS) released the inflation or CPI data, there were a few different figures to consider.

- Consumer prices rose 0.8 per cent during the September quarter (July, August and September).

- Prices are 3% higher than a year earlier.

- The increase was largely because of fuel which increased 7.1% and the cost to build new homes which increased 3.3%.

- The annual trimmed mean gauge accelerated to 2.1% last quarter, returning to the RBA’s 2-3% target for the first time since 2015

The trimmed mean Consumer Price Index (CPI) tends to exclude more of the volatile short term parts of inflation like a sudden spike in petrol prices. This hit a 5 year high.

It is this measure that the RBA watches closely. If it continues higher above 3%, the central bank may be forced to increased interest rates sooner than previously forecast.

Interest rates and the Australian dollar (AUD)

So what if interest rates increase sooner than expected?

Well, interest rates and interest rate expectations have a big influence over the value of the Australian dollar.

At any given time, the expectations for interest rates over a period of time is reflected in the price of bonds. If interest rates are expected to increase more than previously expected, investment flows in because the interest rate return is getting higher. This makes the value of the currency appreciate.

So if interest rate expectations in Australia go up, generally, so does the Australian dollar. One thing to remember though is that other countries may be increasing interest rates too.

For example, if interest rates are expected to increase in the United States at the same pace as Australia, then both currencies may appreciate at roughly the same rate, leaving the AUD to USD exchange rate relatively unchanged.

The Outlook for inflation and the Australian dollar

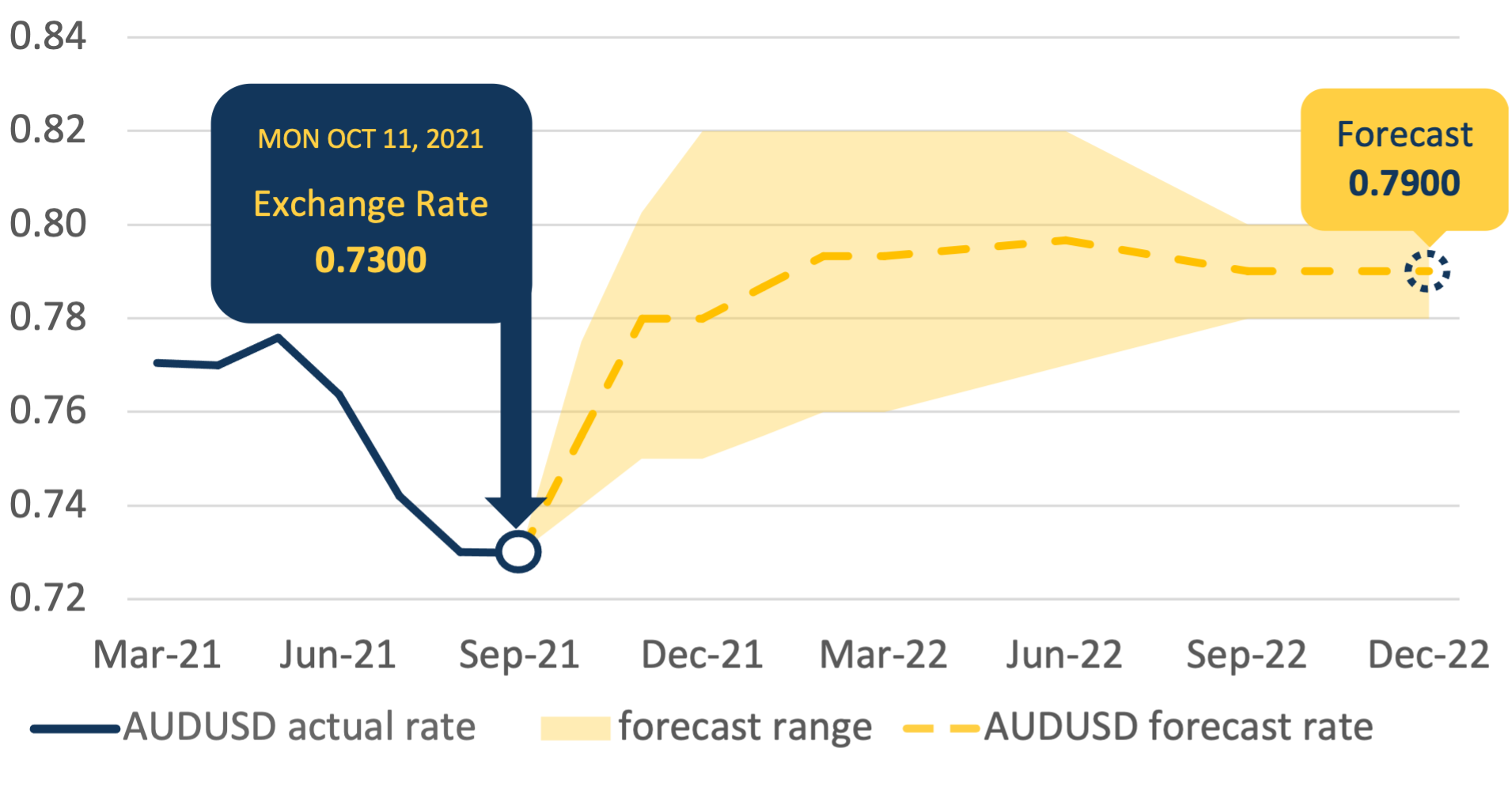

Since June 2021 the Australian dollar has been falling against the US dollar. For the rest of 2021 many economists are expecting a minor rebound to 80 cents, before trending sideways in the new year.

Many economists have lowered their Australian dollar (AUD) forecasts for 2022 to remain between 75 and 80 cents by June, but also expect the bumpy ride to continue.